non ad valorem tax florida

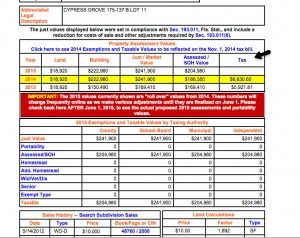

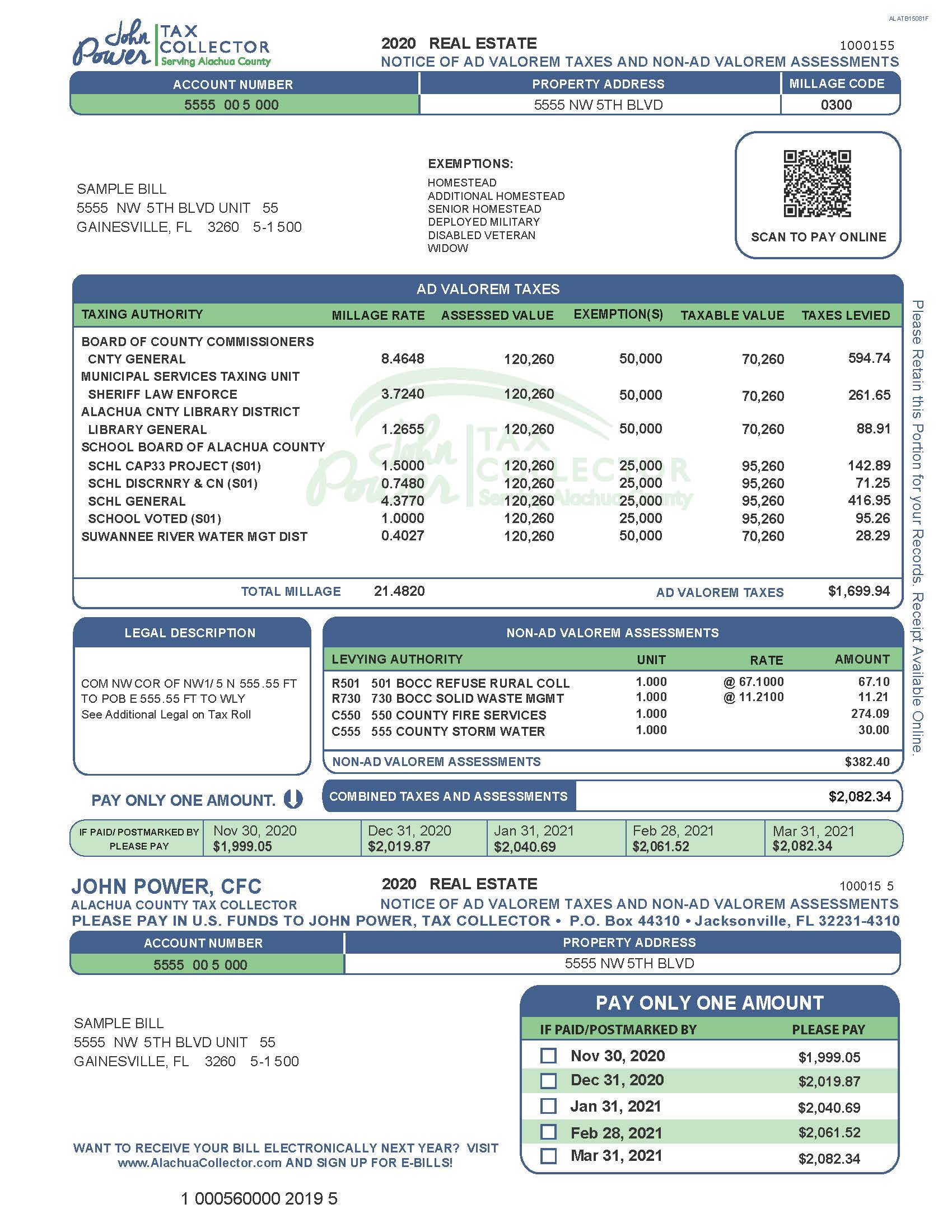

Measured in specific units square footage acres. They are separated from ad valorem taxes on the tax notice by a bold horizontal line.

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Bay Point Wastewater District.

. Nothing in this act shall be deemed to affect any benefit tax maintenance tax non-ad valorem assessment ad valorem tax or special assessment imposed by a community development. Florida Keys Aqueduct Authority. Non-Ad Valorem Assessments may be included on a property owners tax bill.

What are non-ad valorem taxes for. Non-ad valorem assessments collected within their own area include Telephone Number. Each property owner will generally pay the same amount.

Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes. Non-Ad Valorem tax rolls are prepared by local governments and are certified to the tax collectors office for collection. The Legislature first defined non-ad valorem assessment in 1988 in section 1973632ld Florida Statutes.

Non-ad valorem assessments are. Refer to the Form 1040 PDF and Publication 17 for more taxes you cant deduct. Based on the benefit to the property.

1 By complying with the provisions of this rule section a local government may elect to use the ad valorem method of collection for any non-ad valorem assessments. The collection of taxes as well as the assessment is in. Non-ad-valorem assessments are based on the improvement or service cost allocated to a.

Non-ad valorem assessments are primarily assessments for paving services storm water and solid waste collection and disposal. You may also be part of a special district or. The statute did not how-ever invent or create a new or different type of local.

Tangible taxes are not subject to non-ad valorem assessments Non. Some counties use only or nearly only valorem taxes. Conch Key Wastewater District.

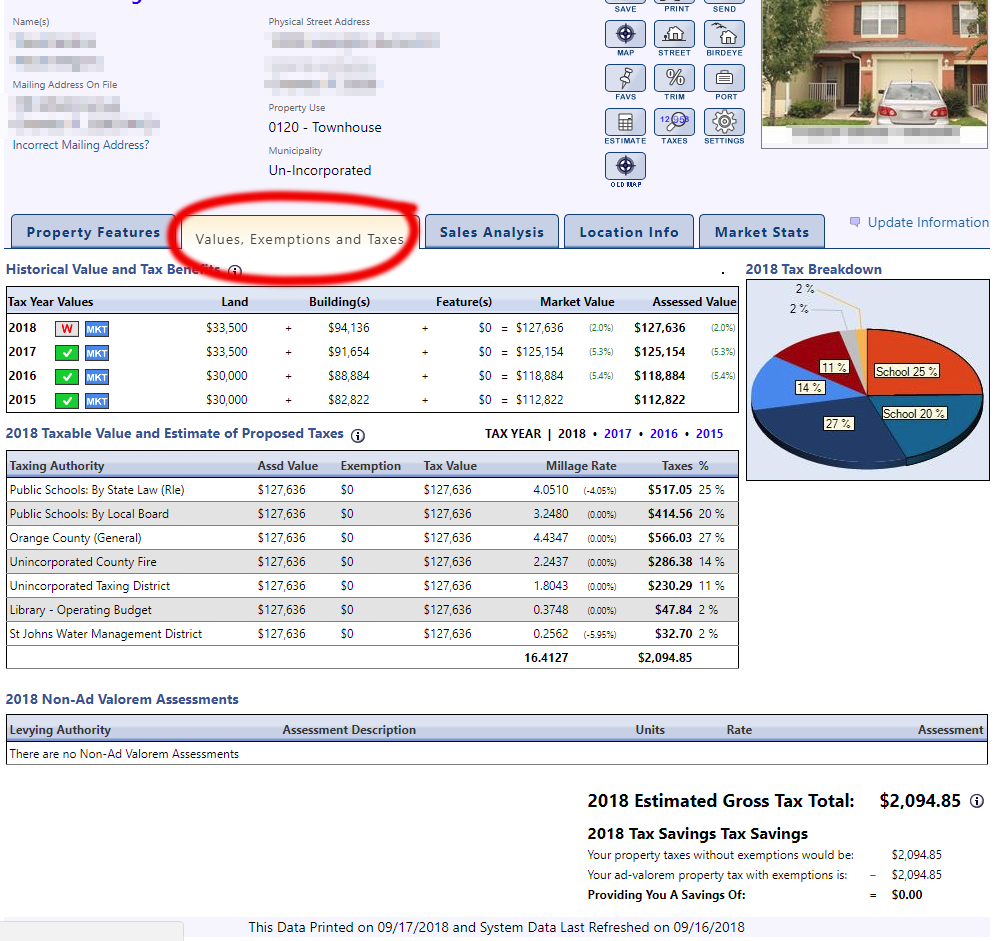

A Non-Ad Valorem Assessment is a legal financing mechanism or method wherein the County establishes a special district to allow a group of citizens to fund a desired improvement such. They are set amounts established by the levying authorities and unlike Ad Valorem taxes they are not. Non-ad valorem assessments are assessed to provide certain.

Authority for Non Ad. If last years household income was less than 10000 all ad valorem taxes and non-ad valorem assessments will be deferred. Special assessments can be placed on the tax roll only if they are also non-ad valorem assessments Non-ad valorem assessments are defined as only those assessments.

Article VII of the Florida Constitution and Chapters 192 193 194 195 196 197 200 and 201 of the Florida Statutes. Authority for Ad Valorem Taxes. A non-ad valorem assessment is a special assessment or service charge which is not based on the value of the property.

A lien against the property. Non-ad valorem taxes are a fixed tax. The Non-Ad Valorem office is responsible for preparing a certified Non-Ad Valorem Assessment Roll for special assessment.

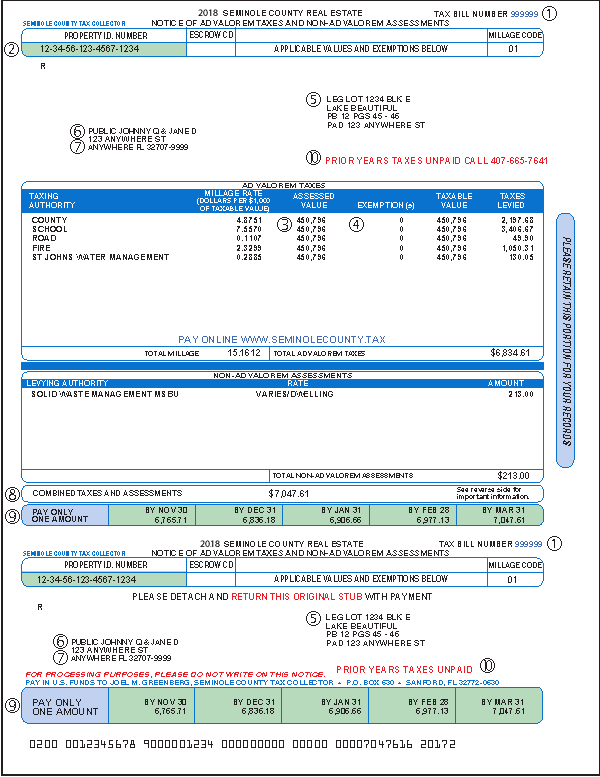

The real estate tax bill is a combined notice of ad valorem taxes and non-ad valorem assessments. A permanent resident of Florida who is 65 years old or older may. Non-ad valorem assessments are NOT based on value but are set amounts.

Non-Ad Valorem assessments are primarily assessments for paving services storm water and solid waste collection and disposal. Florida property taxes vary by county. The collection of taxes as well as the assessment is in.

Non-Ad Valorem assessments are primarily assessments for.

Broward County Property Taxes What You May Not Know

Explaining The Tax Bill For Copb

Real Estate Property Tax Constitutional Tax Collector

Tax Implications Of Canadian Investment In A Florida Rental Property

Property Taxes Highlands County Tax Collector

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Tax Implications Of Canadian Investment In A Florida Rental Property

A Guide To Your Property Tax Bill Alachua County Tax Collector

What Is Florida County Tangible Personal Property Tax

What Is A Florida County Real Property Trim Notice

Florida Property Taxes Explained

Understanding Your Tax Bill Seminole County Tax Collector

Tax News And Information Lower Your Property Taxes With Property Tax Professionals

Tax Implications Of Canadian Investment In A Florida Rental Property

What Is This Trim Notice I Received From The Property Appraiser Lubin Law Property Tax Appeals South Florida